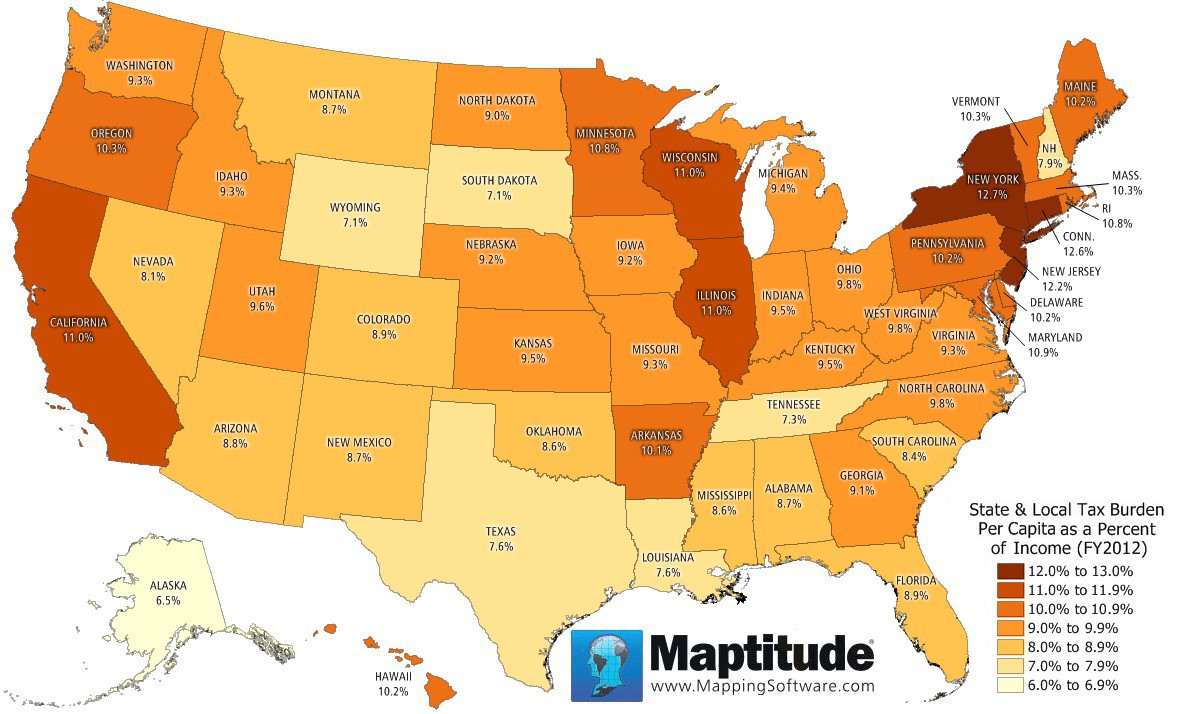

per capita tax burden by state

3 Calculated based on State Local Sales Tax Rates as of January 1 2020. New York and Connecticut have the highest state tax burden state and local tax burden rankings.

Property Tax Definition Property Taxes Explained Taxedu

North Dakota has 99 bars per 10000 people according to Yau and Montana has 86 per.

. States use a different combination of sales income excise taxes and user. In the fiscal year of 2011 the total tax burden. State and Local General Expenditures Per Capita.

However residents of each of the top 10 states pay 3-5 times as much in federal. Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and sales tax but also special taxes like real estate. The reason that Washington ranks higher in.

The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011. We share the overall tax burden by state for an average household to help decide where to move. 1 Best Per Capita includes the population aged 18 and older.

The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25. In the nation and 10th among the 13 western states. Washingtons average tax burden is more than 400 per 1000 below the national average.

See total tax burden by state state and local taxes. There are more quarter horses registered in the state of Oklahoma per capita than anywhere. Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and sales tax but also special not only for income.

Here are the five states with the biggest per capita tax burden according to their calculations. Finally New York Illinois and Connecticut. DC is however a dramatic exception because it is entirely made up of a thriving urban center.

Despite its high tax burden todays report showed New York ranked far down among the list of states in per capita expenditure by state and local governments on education in the fiscal year. Federal Receipts. 211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents.

With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of. State and Local Issues.

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

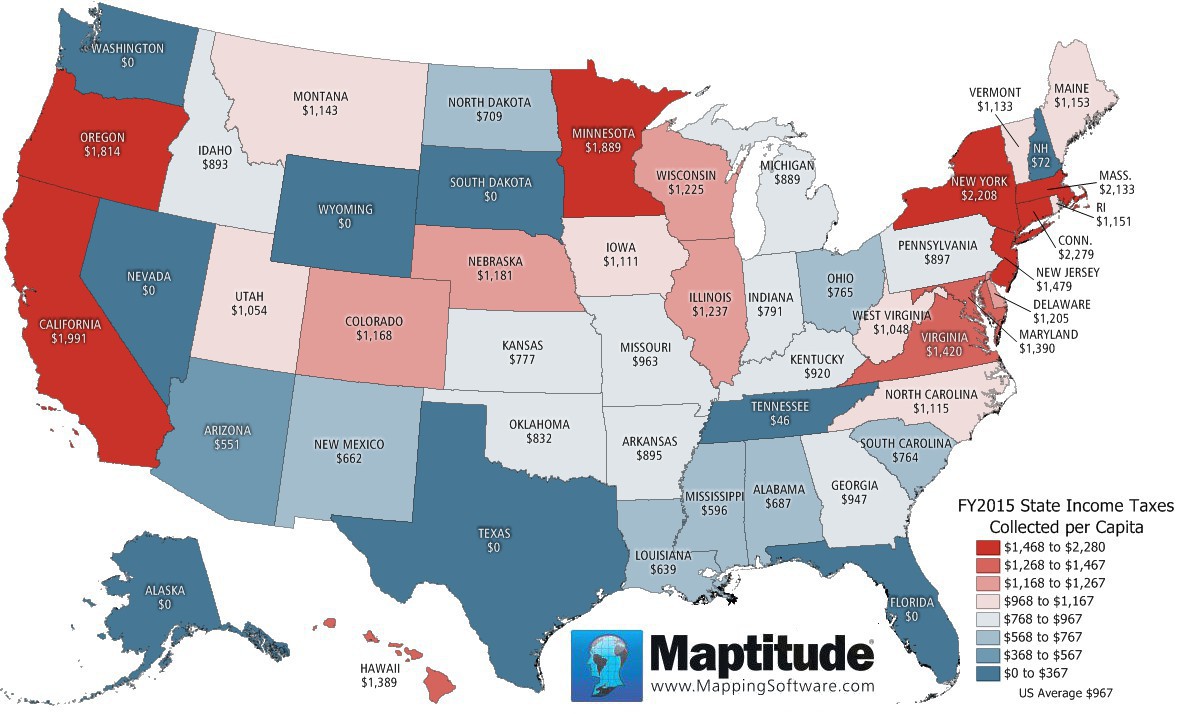

Maptitude Map State Income Tax Burden

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

State Income Tax Collections Per Capita 2010 Map Income Tax Property Tax

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Which States Pay The Most Federal Taxes Moneyrates

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map States

State Income Tax Collections Per Capita Map Graphing Cartography

Individual Income Tax Collections Per Capita Tax Foundation

These States Have The Highest And Lowest Tax Burdens

State By State Guide To Taxes On Retirees Retirement Retirement Income Retirement Planning

State And Local Sales Tax Rates Sales Taxes Tax Foundation

The Worst U S States To Retire In Ranked Finance 101 Gas Tax Healthcare Costs Better Healthcare

100 Richest Red Vs 100 Poorest Blue Counties In The Us By Per Capita Personal Income 1513 X 983 Map Cartography Illustrated Map

State By State Guide To Taxes On Retirees Kiplinger Retirement Tax States

Maptitude Map Per Capita State Income Taxes

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire